The fresh new effect regarding refinancing with the family equity

You are going to decrease your home equity for many who choose an earnings-aside re-finance. Because of the meaning, some of those concerns tapping their collateral. You might be borrowing from the bank currency for mission with a new financial that have a higher equilibrium.

However, other forms of refinancing essentially get off your own level of collateral unaltered or rarely touched. That is unaltered for individuals who loans your own closing costs your self otherwise barely handled when you get their lending company to include these to your new home loan balance.

Opting for a smaller mortgage cycle is a type of refinancing that may rather improve your guarantee. not, reducing the brand new repayment several months will generally enhance your monthly obligations.

What is equity?

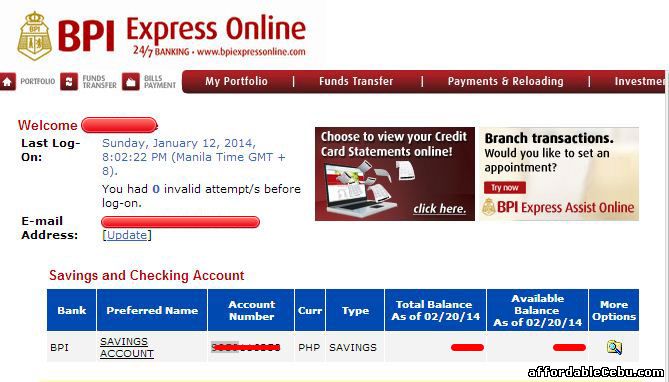

If the a number of one to musical perplexing, you need reminding away from exactly what house guarantee try. Curious simple tips to assess domestic equity? It’s the difference between their house’s current market really worth as well as your financial equilibrium today.

So, supposing you reside now well worth $350,000. Therefore check your mortgage harmony online and select its $150,000. Your property guarantee try $2 hundred,000. ($350,000 market price – $150,000 financial equilibrium = $2 hundred,000 equity.)

Exactly how much security you really have have a tendency to mainly believe just how recently you bought your property as well as how rapidly home values on the urban area features risen. Home values has actually fell from inside the relatively few pockets of your own Joined Says, meaning owners provides negative equity. This basically means, it are obligated to pay regarding their homes than others homes are worth.

But, for the vast majority off home owners, their functions are essential members on the websites wide range. CoreLogic, and this inspections household equity, reckons such as for instance equity enhanced 9.6% anywhere between . When you look at the bucks conditions, men and women property owners together added $1.5 trillion to the value of their homes more than exactly that season.

The common mortgage holder is now offering $299K in security, $193K where are tappable and may even be withdrawn if you’re however keeping a wholesome 20% collateral stake. – Frost Financial Screen,

Would you dump equity once you re-finance? Exactly how refinancing has an effect fast payday loan Green Mountain Falls Colorado on household equity

When you refinance, you improve your current financial which have another that. Even when improve mortgage refinances are going to be less expensive, the newest mortgage loan are likely to come with closing costs and a management weight similar to that from a brand new financial out-of an equivalent dimensions.

So, you are not browsing do that enjoyment. And you may require financial advantages. There have been two types of refis that submit those:

- A speed-and-name refinance – You earn a diminished payment often by detatching the attention rate or by dispersed your instalments thinner by the extending the phrase of financing. Instead, if for example the cashflow try solid, you could potentially lower your mortgage label, increasing your monthly payment but slashing the total price of borrowing

- A cash-away refinance – Your walk away away from closure that have a lump sum payment. And you will create what you need to your money: generate home improvements, combine large-notice expenses or take the holiday you will ever have. But you will getting reducing the collateral of your house by the count you cash-out, as well as closing costs

We stated streamline refinances earlier. These types of will enables you to re-finance your home loan that have quicker problem minimizing will cost you than a regular refi. However, they might be never designed for cash-aside refinances nor if you find yourself trading you to mortgage kind of for the next.

The borrowed funds speed ecosystem

It’s easy to validate a good re-finance when financial prices was shedding. You might be replacing your current mortgage’s high rate of interest with a lesser you to definitely, and that generally cuts back your payment per month. And you can always retract your own settlement costs inside your new home loan. Yet not, men and women will cost you usually a little raise your financial harmony if you do one to. Still, full, it’s hard to identify a drawback.