- BECU was a cards connection you to serves Boeing teams and you may qualified borrowers in Arizona, Idaho, and you can Oregon.

- A ten-season repayment bundle exists for the student loans.

- Student loan and you will refinancing alternatives provides a great cosigner release once 24 successive into the-time repayments.

Situated for the 1935, Boeing Employees Credit Commitment (BECU) 1st supported Boeing staff, credit all of them money to get units to-do its operate. The credit commitment now serves more than 1 million users, and that incorporate Boeing employees, residents, youngsters, churchgoers, and you may entrepreneurs in Washington, Idaho, and you will Oregon.

BECU also offers a variety of banking and you may financing situations, plus examining and you may deals accounts, handmade cards, mortgage loans, figuratively speaking, and you will financial support features. While the you are evaluating a knowledgeable financing choices, see all of our BECU student loans comment to determine.

- Our very own accept BECU’s personal figuratively speaking

- Our very own deal with BECU’s re-finance college loans

- Having qualified to receive BECU personal and you may refinance student loans?

- Positives and negatives off BECU’s college loans and you may refinance funds

BECU’s private figuratively speaking

BECU private figuratively speaking promote way more limited selection than nearly all their competitors. For just one, only a beneficial ten-year private education loan title is obtainable, which could not adequate for those seeking faster otherwise stretched terms. Individuals are also expected to generate costs when you’re nevertheless at school-not totally all lenders have this requirement.

A half a dozen-times grace several months applies abreast of graduation if you are not necessary to help you build prominent-and-desire payments. This will be in accordance with of numerous lenders’ even offers. BECU’s college students cannot necessarily feel the reduced pricing out there, but people that decide into autopay could possibly get be eligible for 0.25% rate discount.

One of many advantages of borrowers who’ve a small credit history otherwise want a better price is with having an effective cosigner. BECU allows so it, as well as cosigner release once and work out straight money to own 24 days.

Although not, the new restrictive borrowing from the bank connection requirements , you really must be a resident, college student, staff member, entrepreneur, or other qualified private in Arizona, Idaho, and you may Oregon becoming how to get a loan Colorado Springs an associate. For individuals who fulfill this type of registration criteria and acquire these funds give you the most useful pricing, it could be worth a peek.

Pricing, terminology, and much more

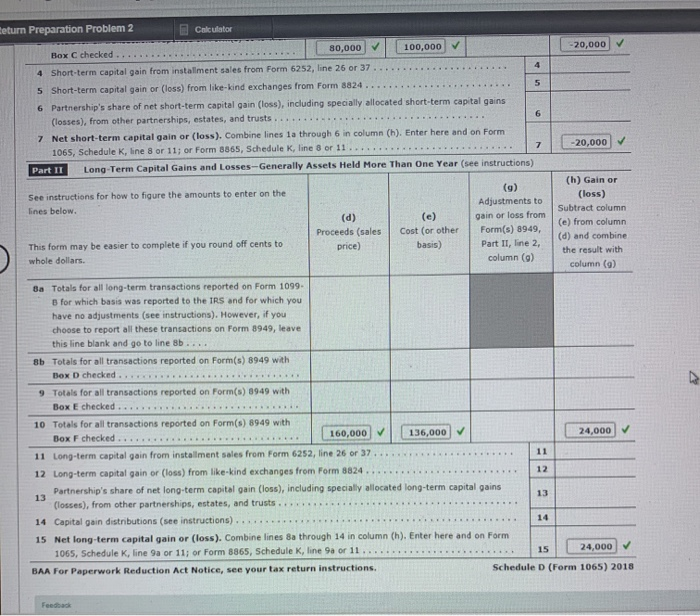

Costs to possess BECU student loan prices during the time of creating is greater than almost every other common student loan lenders. One fees term is obtainable, but you can prefer attention-merely payments otherwise a $twenty-five payment whilst in university. Below, you could comment BECU figuratively speaking costs, terms, or other distinguished has.

BECU lovers which have Lendkey so you’re able to provider the figuratively speaking. Their student loans have a ten-year fees title, and you can borrowers keeps two within the-college or university repayment choices:

- Fixed $25 monthly payment

- Interest-merely costs at good $25 minimum

For each fee option comes with different performing APRs-this new $25 payment alternative have a reduced speed. This new from inside the-university payments are on par with what almost every other lenders give, but most render alot more alternatives for the fees terminology. BECU, additionally, also provides zero possibilities. People are simply for the latest 10-12 months name.

After you scholar out of your university system otherwise are not any offered enrolled half-time, BECU offers a half a dozen-week elegance period before you start full principal-and-notice financing payments. If you don’t, the complete payment period may start 60 weeks just after your loan are disbursed to possess an student system otherwise forty-eight weeks to own an excellent graduate system (if the earlier than the graduation big date).

Within the complete installment months, your own minimum commission was $50 a month. An excellent 10-seasons cost months you will suggest purchasing significantly more for the focus than simply finance which have smaller terminology because the you’ll generate a whole lot more appeal costs. If you want a smaller cost label, you are going to need to wade in other places.