A gift page are a formal and you may lawfully joining file you to definitely states a massive sum of money try skilled to you personally from the good donor. They officially announces the cash is a present and not that loan that really must be paid off.

A present letter is actually a proper document proving that money you are using getting a down-payment to the a mortgage try given to your once the a present. Brand new gift letter, authored by the brand new donor, states that there surely is no expectation regarding installment.

For individuals who acquired an economic provide you propose to use towards the home financing down-payment or closing costs, you need to provide a present page to show the money is not a loan.

During the underwriting techniques having an interest rate, loan providers evaluate a loan applicant’s economy and be certain that he’s got the fresh new ways to repay the borrowed funds.

A present letter legitimizes the reason off money and you may guarantees any large dumps to your membership are genuine presents rather than an most loan just be sure to pay off.

It’s prominent having newly weds for currency given that a married relationship present. Eg, suppose you only had married, along with your grandparents gave you $fifteen,000 while the a wedding present. You can use this money towards a downpayment and you may closing can cost you towards a house. To accomplish this, you’ll want the grandparents set up a present page you to definitely you can provide to a home loan company. The brand new current letter have a tendency to imply the link to your, the particular number and you may source of the funds, and you may suggest that you might be lower than zero responsibility to pay they right back.

How come a gift Page Performs?

The newest gift-giver need produce and you will indication the latest current page. Its more comfortable for brand new recipient to save a gift page towards the document whether your donor will bring it during the provide. However, this won’t usually happen.

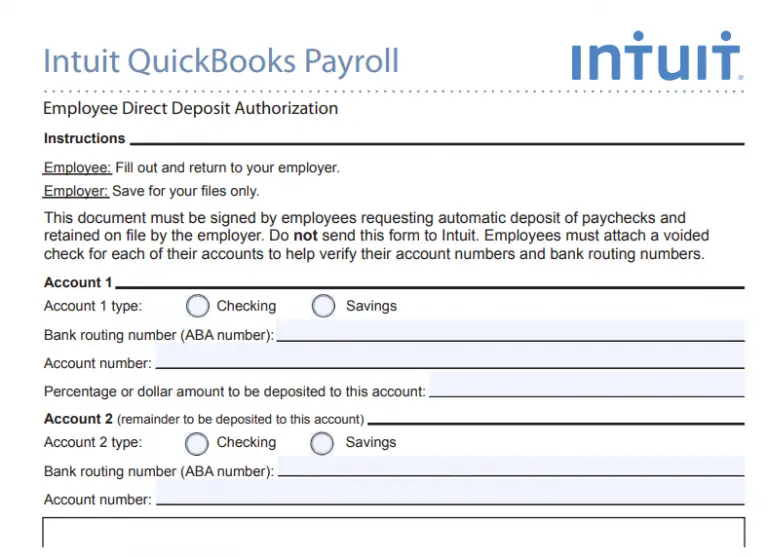

In the event that you need do something special page, lenders are certain to get a template available or you can find that on the internet. Generally, something special page ought to include the following suggestions:

- The money quantity of the fresh new current

- The fresh new donor’s identity, target, and phone number

- New donor’s link to the mortgage applicant

- This new time the cash had been otherwise will be moved

- A statement that no fees is anticipated

- Brand new address of the home are ordered (in the event that recognized at the time)

- The new individual and donor’s signatures

Double-talk with the lending company on which advice it must getting integrated. Really loan providers will want to opinion what encompassing the latest gift that will request more documents including lender comments, examine copies, and you will evidence of cord import. This research is performed in order to confirm your debts, determine exposure, and make certain you can pay off the mortgage you are applying the skilled money so you’re able to.

If you are planning into the using marriage provide money to put a beneficial down payment on the a house, make certain that referring out-of a qualified donor. Present page standards and you may acceptable donors will vary by the home mortgage style of.

Financing individuals is also located and employ economic gifts off numerous supplies. But not, might you need something special letter for each contribution. Merchandise may come in the form of dollars or equity, usually.

While provide emails are most typical with home loan off repayments easy cash loans in Oakland, they may be delivered to home planning aim otherwise with a good current off collateral. An equity provide page comes with a home income less than market price. Which always is when people gifts real-estate to help you a relative.

Types of Gifting

The entire gifting direction for the most prominent mortgages was the following. For each and every mortgage program has its own guidelines on number of current funds you could potentially implement.

Old-fashioned Loans

Simply merchandise out of a close relative try appropriate for antique loans courtesy Freddie Mac computer otherwise Fannie mae. This may involve people associated with the fresh individual by the blood, relationship, or use, such as a wife, home-based lover, bride to be, youngster, mainly based, grandparent, sibling, buddy, relative, nephew, cousin, otherwise guardian. The donor can’t be an interested party throughout the home deal.

FHA Money

Having an individual-family relations Government Homes Expert (FHA) loan, gifts of all the relatives (from the bloodstream, relationship, foster, or use) is actually acknowledged except cousins, nieces, and you may nephews. Merchandise also are acknowledged from companies, labor unions, best friends, charitable teams, governmental companies, or social entities for lowest- and you can modest-money group or earliest-time homeowners.

Virtual assistant and you can USDA Fund

The only present significance of Service regarding Experts Things (VA) finance and you may Company regarding Agriculture (USDA) finance is that the donor cannot be an interested party inside your order for those categories of loans. Such as for example, the fresh new donor can not be a vendor, builder, developer, otherwise realtor on domestic becoming ordered.

How much Was Provide Letter Taxes?

Not all the gift suggestions is actually nonexempt. If they are, the fresh donor is often the individual that will pay the fresh new provide tax except if the present person makes an arrangement to invest they.

Since 2021, the new Irs says that the annual exception to this rule towards something special each people a year is actually $15,000. It indicates brand new donor would have to spend fees and you can document a gift income tax get back for the one number more than you to definitely. Including, when someone will provide you with $25,000, they’ve to pay fees for the count across the yearly exemption, that is $10,000 in such a case.

Married people takes advantageous asset of a present breaking income tax rule and present as much as $30,000 shared as opposed to incurring income tax charges.

The brand new lifestyle present taxation difference to possess 2021 are $11.7 million. It indicates some one deliver to $11.seven billion during their lifetime without having to be taxed inside it. That count grows to help you $23.cuatro billion to have married couples: $eleven.7 million for every companion.

In the event provide number slide into the Irs present exceptions and exemptions, donors commonly still have to document an income tax go back very its donations is going to be mentioned with the the lifetime income tax exception.